UNITED STATES

SECURITIES AND EXCHANGE COMMISSION

Washington, D.C. 20549

SCHEDULE 14A

(Rule 14a-101)

INFORMATION REQUIRED IN PROXY STATEMENT

SCHEDULE 14A INFORMATION

Proxy Statement Pursuant to Section 14(a) of the

Securities Exchange Act of 1934 (Amendment No. ___)

Filed by the Registrantx

Filed by a Party other than the Registrant¨

Check the appropriate box:

| ¨ | Preliminary Proxy Statement |

| ¨ | Confidential, for Use of the Commission Only (as permitted by Rule 14a-6(e)(2)) |

| x | Definitive Proxy Statement |

| ¨ | Definitive Additional Materials |

| ¨ | Soliciting Material Pursuant to Rule 14a-12 |

AMREP CORPORATION

(Name of Registrant as Specified In Its Charter)

(Name of Person(s) Filing Proxy Statement, if Other Than the Registrant)

Payment of Filing Fee (Check the appropriate box):

| x | No fee required. |

| ¨ | Fee computed on table below per Exchange Act Rules 14a-6(i)(4) and 0-11. |

| 1) | Title of each class of securities to which transaction applies: | |

| 2) | Aggregate number of securities to which transaction applies: | |

| 3) | Per unit price or other underlying value of transaction computed pursuant to Exchange Act Rule 0-11 (set forth the amount on which the filing fee is calculated and state how it was determined): | |

| 4) | Proposed maximum aggregate value of transaction: | |

| 5) | Total fee paid: | |

| ¨ | Fee paid previously with preliminary materials: |

| ¨ | Check box if any part of the fee is offset as provided by Exchange Act Rule 0-11(a)(2) and identify the filing for which the offsetting fee was paid previously. Identify the previous filing by registration statement number, or the form or schedule and the date of its filing. |

| 1) | Amount Previously Paid: | |

| 2) | Form, Schedule or Registration Statement No.: | |

| 3) | Filing Party: | |

| 4) | Date Filed: | |

AMREP CORPORATION

(An Oklahoma corporation)

NOTICE OF 20142015 ANNUAL MEETING OF SHAREHOLDERS

September 10, 20142015

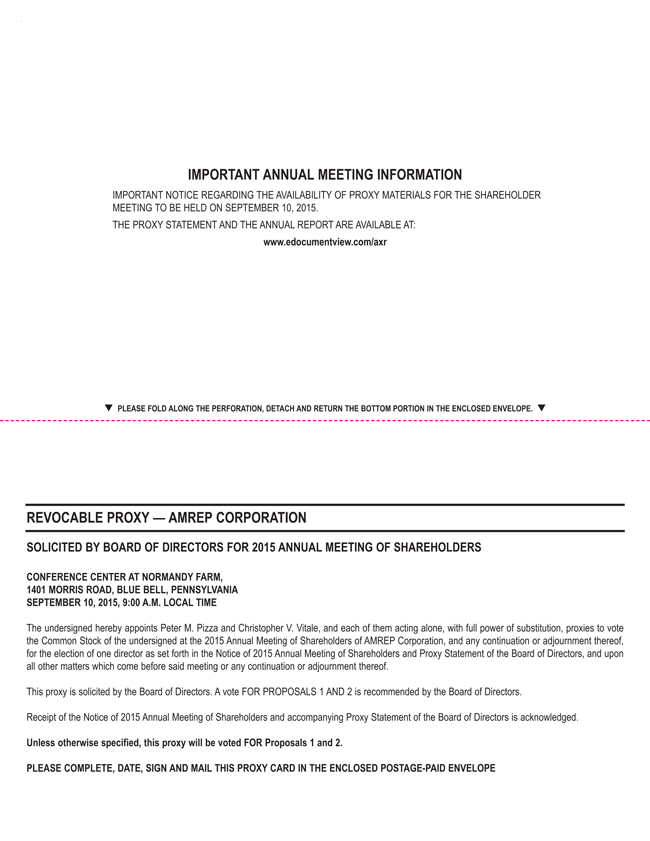

NOTICE IS HEREBY GIVEN that the 20142015 Annual Meeting of Shareholders of AMREP Corporation (the “Company”) will be held at the Conference Center at Normandy Farm, Route 202 and1401 Morris Road, Blue Bell, Pennsylvania on September 10, 20142015 at 9:00 A.M. Eastern Time for the following purposes:

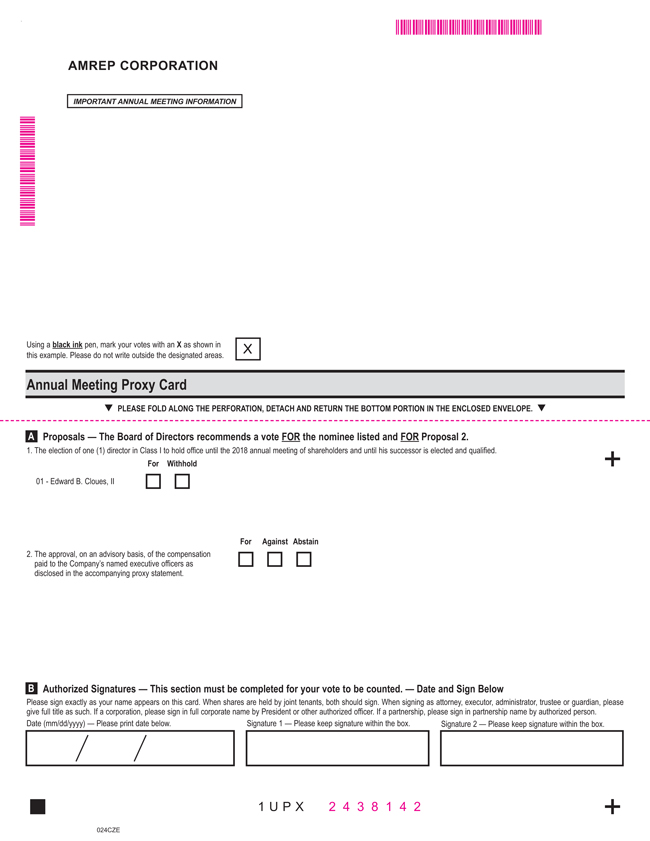

(1) To elect two directorsone director in Class IIII to hold office until the 20172018 annual meeting of shareholders and until their successors arehis successor is elected and qualified;

(2) To approve, on an advisory basis, the compensation paid to the Company’s named executive officers as disclosed in the accompanying proxy statement; and

(3) To consider and act upon such other business as may properly come before the meeting.

In accordance with the Company’s By-Laws, the Board of Directors has fixed the close of business on August 1, 2014July 24, 2015 as the record date for the determination of shareholders of the Company entitled to notice of and to vote at the meeting and any continuation or adjournment thereof. The list of such shareholders will be available for inspection by shareholders during the ten days prior to the meeting at the offices of the Company, 300 Alexander Park, Suite 204, Princeton, New Jersey 08540.

Whether or not you expect to be present at the meeting, please mark, date and sign the enclosed proxy and return it to the Company in the self-addressed envelope enclosed for that purpose. The proxy is revocable and will not affect your right to vote in person in the event you attend the meeting.

| By Order of the Board of Directors | |

| Christopher V. Vitale,Secretary |

| Dated: | August |

| Princeton, New Jersey |

Important Notice Regarding the Availability of Proxy Materials

for the Shareholder Meeting to be Held on September 10, 2014

2015

The Proxy Statement and Annual Report to Shareholders are available at http://www.cfpproxy.com/6674.www.edocumentview.com/axr.

| Upon the written request of any shareholder of the Company, the Company will provide to such shareholder a copy of the Company’s annual report on Form 10-K for the fiscal |

AMREP CORPORATION

300 Alexander Park, Suite 204

Princeton, New Jersey 08540

PROXY STATEMENT

ANNUAL MEETING OF SHAREHOLDERS

To be Held at 9:00 A.M. Eastern Time on September 10, 20142015

This proxy statement (the “Proxy Statement”) is furnished in connection with the solicitation of proxies by the Board of Directors (the “Board”) of AMREP Corporation (the “Company”) for use at the Annual Meeting of Shareholders of the Company to be held on September 10, 2014,2015, and at any continuation or adjournment thereof (the “Annual Meeting”). The Annual Meeting will be held at the Conference Center at Normandy Farm, Route 202 and1401 Morris Road, Blue Bell, Pennsylvania.

The Annual Report of the Company on Form 10-K for the fiscal year ended April 30, 20142015 filed on July 29, 20142015 with the Securities and Exchange Commission is included in this mailing but does not constitute a part of the proxy solicitation material. This Proxy Statement and the accompanying Notice of 20142015 Annual Meeting of Shareholders and proxy card are first being sent to shareholders on or about August 7,6, 2015. All references in this Proxy Statement to fiscal 2015 and fiscal 2014 mean the Company’s fiscal years ended April 30, 2015 and 2014.

QUESTIONS AND ANSWERS CONCERNING THE ANNUAL MEETING

What will be voted on at the Annual Meeting?

There are two matters scheduled for a vote:

| · | Proposal Number 1: Election of |

| · | Proposal Number 2: Approval, on an advisory basis, of the compensation paid to the Company’s named executive officers as disclosed in this Proxy Statement. |

What if another matter is properly brought before the Annual Meeting?

The Board knows of no other matters that will be presented for consideration at the Annual Meeting. If any other matters are properly brought before the Annual Meeting, it is the intention of the persons named in the accompanying proxy to vote on those matters in accordance with their best judgment.

How does the Board recommend I vote on the proposals?

The Board recommends that you vote “FOR” the election as directorsdirector of the nomineesnominee named in this Proxy Statement. In addition, the Board recommends that you vote “FOR” the approval, on an advisory basis, of the compensation paid to the Company’s named executive officers as disclosed in this Proxy Statement.

Who is entitled to vote at the Annual Meeting?

Only shareholders of record as of the close of business on August 1, 2014,July 24, 2015, the date fixed by the Board in accordance with the Company’s By-Laws, are entitled to notice of and to vote at the Annual Meeting.

If I have given a proxy, how do I revoke that proxy?

Anyone giving a proxy may revoke it at any time before it is exercised by giving the Secretary of the Company written notice of the revocation, by submitting a proxy bearing a later date or by attending the Annual Meeting and voting.

How will my proxy be voted?

All properly executed, unrevoked proxies in the enclosed form that are received in time will be voted in accordance with the shareholders’ directions and, unless contrary directions are given, will be voted “FOR” the election as directorsdirector of the nomineesnominee named in this Proxy Statement and “FOR” the approval, on an advisory basis, of the compensation paid to the Company’s named executive officers as disclosed in this Proxy Statement.

What if a nominee is unwilling or unable to serve?

This is not expected to occur but, in the event that it does, proxies will be voted for a substitute nominee designated by the Board or, in the discretion of the Board, the position may be left vacant.

What are “broker non-votes”?

Under the rules that govern brokers, if brokers or nominees who hold shares in “street name” on behalf of beneficial owners do not have instructions on how to vote on matters deemed by the New York Stock Exchange to be “non-routine” (which include the proposals in this Proxy Statement), a broker non-vote of those shares will occur, which means the shares will not be voted on such matters. If your shares are held in “street name,” you must cast your vote or instruct your nominee or broker to do so if you want your vote to be counted with respect to the proposals in this Proxy Statement.

How are votes counted?

Votes will be counted by the inspector of election appointed for the Annual Meeting, who will separately count votes as follows:

| · | for Proposal Number 1 (for the election of |

| · | for Proposal Number 2 (approval, on an advisory basis, of the compensation paid to the Company’s named executive officers as disclosed in this Proxy Statement), votes “For” and “Against,” abstentions and broker non-votes. Abstentions are treated as shares present and entitled to vote on Proposal Number 2 and, therefore, will have the same effect as a vote “Against” Proposal Number 2. |

Broker non-votes have no effect and will not be counted towards the vote total for any proposal.

| - 2 - |

How many votes are needed to approve each proposal?

| · | With respect to Proposal Number 1 (for the election of |

| · | Proposal Number 2 (approval, on an advisory basis, of the compensation paid to the Company’s named executive officers as disclosed in this Proxy Statement) must receive “For” votes from the holders of a majority of shares present in person or represented by proxy and entitled to vote in order to be approved. |

How many shares can be voted at the Annual Meeting?

As of August 1, 2014,July 24, 2015, the Company had issued and outstanding 8,056,4548,059,454 shares of common stock, par value $.10 per share (“Common Stock”). Each share of Common Stock is entitled to one vote on matters to come before the Annual Meeting.

How many votes will I be entitled to cast at the Annual Meeting?

You will be entitled to cast one vote for each share of Common Stock you held at the close of business on August 1, 2014,July 24, 2015, the record date for the Annual Meeting, as shown on the list of shareholders at that date prepared by the Company’s transfer agent for the Common Stock.

What is a “quorum?”

The presence, in person or by proxy, of the holders of a majority of the outstanding shares of Common Stock of the Company authorized to vote will constitute a quorum for the transaction of business at the Annual Meeting. Abstentions will be counted in determining whether a quorum is present at the Annual Meeting. Broker non-votes will not be counted in determining whether a quorum is present at the Annual Meeting since broker non-votes have no effect and will not be counted towards the vote total for any proposal contained in this Proxy Statement. A quorum must be present in order to transact business at the Annual Meeting.

Who may attend the Annual Meeting?

All shareholders of the Company who owned shares of record at the close of business on August 1, 2014July 24, 2015 may attend the Annual Meeting. If you want to vote in person and you hold Common Stock in street name (i.e., your shares are held in the name of a broker, dealer, custodian bank or other nominee), you must obtain a proxy card issued in your name from the firm that holds your shares and bring that proxy card to the Annual Meeting, together with a copy of a statement from that firm reflecting your share ownership as of the record date, and valid identification. If you hold your shares in street name and want to attend the Annual Meeting but not vote in person, you must bring to the Annual Meeting a copy of a statement from the firm that holds your shares reflecting your share ownership as of the record date, and valid identification.

| - 3 - |

COMMON STOCK OWNERSHIP OF

CERTAIN BENEFICIAL OWNERS AND MANAGEMENT

Set forth in the following table is information concerning the beneficial ownership, as defined in Rule 13d-3 under the Securities Exchange Act of 1934, as amended, of Common Stock by the persons who, to the knowledge of the Company, own beneficially more than 5% of the outstanding shares. The table also sets forth the same information concerning beneficial ownership for each director of the Company, each named executive officer of the Company, and all directors and executive officers of the Company as a group. Unless otherwise indicated, (i) reported ownership is as of August 1, 2014,July 24, 2015, and (ii) the Company understands that the beneficial owners have sole voting and investment power with respect to the shares beneficially owned by them. In the case of directors and executive officers, the information below has been provided by such persons at the request of the Company.

Beneficial Owner | Shares Owned | % of | ||||||

| Nicholas G. Karabots, et al | 2,096,061 | (1) | 26.0 | |||||

| Albert V. Russo(Director), Lena Russo, Clifton Russo, Lawrence Russo | 1,273,867 | (2) | 15.8 | |||||

| Bauer Media Group USA, LLC (f/k/a Heinrich Bauer (USA) LLC) | 825,000 | (3) | 10.2 | |||||

| Robert E. Robotti, et al | 571,590 | (4) | 7.1 | |||||

| John H. Lewis, et al | 471,983 | (5) | 5.9 | |||||

| Other Directors and Executive Officers | ||||||||

| Edward B. Cloues, II | 3,000 | * | ||||||

| Lonnie A. Coombs | 3,766 | * | ||||||

| Theodore J. Gaasche | - | - | ||||||

| Jonathan B. Weller | 1,800 | * | ||||||

| Rory Burke | 6,000 | (6) | * | |||||

| Peter M. Pizza | 9,000 | (7) | * | |||||

| Christopher V. Vitale | 18,000 | (8) | * | |||||

| Directors and Executive Officers as a Group (8 persons) | 1,315,433 | 16.3 | ||||||

| Beneficial Owner | Shares Owned Beneficially | % of Class | ||||||

| Nicholas G. Karabots, et al | 2,096,061 | (1) | 26.0 | |||||

Albert V. Russo(Director), Lena Russo, Clifton Russo, Lawrence Russo | 1,273,867 | (2) | 15.8 | |||||

| Heinrich Bauer (USA) LLC | 825,000 | (3) | 10.2 | |||||

| John H. Lewis, et al | 665,839 | (4) | 8.3 | |||||

| Robert E. Robotti, et al | 571,590 | (5) | 7.1 | |||||

| Other Directors and Executive Officers | ||||||||

| Edward B. Cloues, II | 3,000 | * | ||||||

| Lonnie A. Coombs | 3,766 | * | ||||||

| Theodore J. Gaasche | - | - | ||||||

| Jonathan B. Weller | 1,800 | * | ||||||

| Rory Burke | 6,000 | (6) | * | |||||

| Michael P. Duloc | 2,500 | (7) | * | |||||

| Peter M. Pizza | 9,000 | (8) | * | |||||

| Christopher V. Vitale | 15,000 | (9) | * | |||||

| Directors and Executive Officers as a Group (9 persons) | 1,314,933 | 16.3 | ||||||

* Indicates less than 1%.

| (1) | The following table sets forth information regarding the beneficial ownership of Common Stock by Nicholas G. Karabots, Glendi Publications, Inc. and Kappa Media Group, Inc., each of P.O. Box 736, Fort Washington, PA 19034. The information in the table is based solely on Amendment No. 31 filed jointly by these persons on March 14, 2014 to the Schedule 13D filed with the Securities and Exchange Commission on August 4, 1993. |

| Beneficial Owner | Shares Owned Beneficially | % of Class (a) | ||||||

| Nicholas G. Karabots | 2,096,061 | (b) | 26.0 | |||||

| Glendi Publications, Inc. | 1,481,724 | (c) | 18.4 | |||||

| Kappa Media Group, Inc. | 512,337 | (d) | 6.4 | |||||

| - 4 - |

| Beneficial Owner | Shares Owned Beneficially | % of Class | ||||||

| Nicholas G. Karabots | 2,096,061 | (a) | 26.0 | |||||

| Glendi Publications, Inc. | 1,481,724 | (b) | 18.4 | |||||

| Kappa Media Group, Inc. | 512,337 | (c) | 6.4 | |||||

| (a) |

| Mr. Karabots has sole power to vote or direct the vote, and sole power to dispose or direct the disposition, of such shares, of which 1,994,061 shares are owned indirectly through Glendi Publications, Inc. and Kappa Media Group, Inc. |

| Mr. Karabots has the sole power to vote or direct the vote, and sole power to dispose or direct the disposition, of these shares, which are directly owned by Glendi Publications, Inc. |

| Mr. Karabots has the sole power to vote or direct the vote, and sole power to dispose or direct the disposition, of these shares, which are directly owned by Kappa Media Group, Inc. |

| (2) | Albert V. Russo, Lena Russo, Clifton Russo and Lawrence Russo, each c/o American Simlex Company, 401 Broadway, New York, NY 10013, have reported that they share voting power as to these shares and that each of them has sole dispositive power as to the following numbers of such shares representing the indicated percentages of the outstanding Common Stock: Albert V. Russo – 821,068 (10.2%); Lena Russo – 33,740 (0.4%); Clifton Russo – 237,617 |

| (3) | The information in the table is based solely on a Schedule 13G filed by this person with the Securities and Exchange Commission on June 24, 2014. The principal address of |

| (4) |

| Beneficial Owner | Shares Owned Beneficially | % of Class (a) | ||||||

| John H. Lewis | 665,839 | (b) | 8.3 | |||||

| Osmium Partners | 641,339 | (c) | 8.0 | |||||

| Fund I | 248,752 | (d) | 3.1 | |||||

| Fund II | 345,858 | (d) | 4.3 | |||||

| Fund III | 46,729 | (d) | * | |||||

| Fund IV | - | * | ||||||

In an institutional investment manager’s report on Form 13F filed by Osmium Partners with the Securities and Exchange Commission on May 14, 2014, Osmium Partners reported that, at March 31, 2014, it had sole voting authority and investment discretion over 24,500 shares of Common Stock and shared voting authority and investment discretion over an additional 636,135 shares of Common Stock.

| The following table sets forth information regarding the beneficial ownership of Common Stock by Robert E. Robotti, Robotti & Company, Incorporated (“R&CoI”), Robotti & Company, LLC (“R&CoL”), Robotti & Company Advisors, LLC (“R&CoA”) and RVB Value Fund, L.P. (“RV”), each of 6 East 43rd Street, New York, NY 11017-4651, Kenneth R. Wasiak of 488 Madison Avenue, New York, NY 10022 and Ravenswood Management Company, L.L.C. (“RMC”), The Ravenswood Investment Company, L.P. (“RIC”) and Ravenswood Investments III, L.P. (“RI”), each of 104 Gloucester Road, Massapequa, NY 11758. The information in the table is based solely on Amendment 2 filed jointly by these persons on February 15, 2012 to the Schedule 13D filed with the Securities and Exchange Commission on October 26, 2007. |

| Beneficial Owner | Shares Owned Beneficially | % of Class | ||||||

| Robert E. Robotti | 571,590 | (a),(b),(c),(d),(e) | 7.1 | |||||

| R&CoI | 571,590 | (a),(b) | 7.1 | |||||

| R&CoL | 4,100 | (a) | * | |||||

| R&CoA | 567,490 | (b) | 7.0 | |||||

| RV | 23,322 | (c) | * | |||||

| Kenneth R. Wasiak | 160,887 | (c),(d),(e) | 2.0 | |||||

| RMC | 160,887 | (c),(d),(e) | 2.0 | |||||

| RIC | 86,597 | (d) | 1.1 | |||||

| RI | 50,698 | (e) | * | |||||

| Beneficial Owner | Shares Owned Beneficially | % of Class (a) | ||||||

| Robert E. Robotti | 571,590 | (b),(c),(d),(e),(f) | 7.1 | |||||

| R&CoI | 571,590 | (b),(c) | 7.1 | |||||

| R&CoL | 4,100 | (b) | * | |||||

| R&CoA | 567,490 | (c) | 7.1 | |||||

| RV | 23,322 | (d) | * | |||||

| Kenneth R. Wasiak | 160,887 | (d),(e),(f) | 2.0 | |||||

| RMC | 160,887 | (d),(e),(f) | 2.0 | |||||

| RIC | 86,597 | (e) | 1.1 | |||||

| RI | 50,698 | (f) | * | |||||

| * | Indicates less than 1%. |

| - 5 - |

| (a) |

| Each of Mr. Robotti and R&CoI share with R&CoL the power to vote or direct the vote, and the power to dispose or direct the disposition, of 4,100 shares of Common Stock owned by the discretionary customers of R&CoL. |

| Each of Mr. Robotti and R&CoI share with R&CoA the power to vote or to direct the vote, and the power to dispose or direct the disposition, of 406,603 shares of Common Stock owned by the advisory clients of R&CoA. |

| Each of RMC and Messrs. Robotti and Wasiak share with RV the power to vote or to direct the vote, and the power to dispose or to direct the disposition, of 23,322 shares of Common Stock owned by RV. |

| Each of RMC and Messrs. Robotti and Wasiak share with RIC the power to vote or direct the vote, and the power to dispose or direct the disposition, of 86,597 shares of Common Stock owned by RIC. |

| Each of RMC and Messrs. Robotti and Wasiak share with RI the power to vote or to direct the vote, and the power to dispose or direct the disposition, of 50,698 shares of Common Stock owned by RI. |

In an institutional investment manager’s report on Form 13F filed by Mr. Robotti with the Securities and Exchange Commission on May 15, 2014,2015, he reported that, at March 31, 2014,2015, he had sole voting authority and shared investment discretion over 697,833695,763 shares of Common Stock and sole voting authority and investment discretion over an additional 4,1305,030 shares of Common Stock.

| (5) | The following table sets forth information regarding the beneficial ownership of Common Stock by John H. Lewis, Osmium Partners, LLC (“Osmium Partners”), Osmium Capital, LP (“Fund I”), Osmium Capital II, LP (“Fund II”), Osmium Spartan, LP (“Fund III”) and Osmium Diamond, LP (“Fund IV”; Fund I, Fund II, Fund III and Fund IV, collectively, the “Funds”), each of 300 Drakes Landing Road, Suite 172, Greenbrae, CA 94904. The information in the table is based solely on a Schedule 13G filed jointly by these persons with the Securities and Exchange Commission on February 17, 2015. |

| Beneficial Owner | Shares Owned Beneficially | % of Class | ||||||

| John H. Lewis | 471,983 | (a) | 5.9 | |||||

| Osmium Partners | 447,483 | (b) | 5.6 | |||||

| Fund I | 233,457 | (c) | 2.9 | |||||

| Fund II | 167,297 | (c) | 2.1 | |||||

| Fund III | 46,729 | (c) | * | |||||

| Fund IV | - | - | ||||||

| * | Indicates less than 1%. |

| (a) | Mr. Lewis has sole power to vote or direct the vote, and sole power to dispose or direct the disposition, of 24,500 of such shares, and shares with Osmium Partners the power to vote or direct the vote, and the power to dispose or direct the disposition, of a total of 447,483 of such shares, which are directly owned by the Funds. |

| (b) | Osmium Partners shares with Mr. Lewis the power to vote or direct the vote, and dispose or direct the disposition, of these shares, which are directly owned by the Funds. |

| (c) | The shares are directly owned by the beneficial owner, and the power to vote or direct the vote, and the power to dispose or direct the disposition, of such shares is shared with Mr. Lewis and Osmium Partners. |

| - 6 - |

In an institutional investment manager���s report on Form 13F filed by Osmium Partners with the Securities and Exchange Commission on May 15, 2015, Osmium Partners reported that, at March 31, 2015, it had sole voting authority and investment discretion over 11,621 shares of Common Stock and shared voting authority and investment discretion over an additional 426,493 shares of Common Stock.

| (6) |

| (7) |

| Includes 4,000 restricted shares of Common Stock that vested one-half on August 1, 2015 and will vest one-half on August 1, 2016 and 2,000 restricted shares of Common Stock that will vest one-half on |

| Includes 6,000 restricted shares of Common Stock that vested one-half on August 1, 2015 and will vest one-half on August 1, 2016, 4,000 restricted shares of Common Stock that will vest one-half on |

| - |

PROPOSAL NUMBER 1

ELECTION OF DIRECTORSDIRECTOR

The Board is a classified board divided into three classes– Class I, Class II and Class III. Class I and III each consists of two directors and Class II consists of one director. Each director serves for a term expiring at the annual meeting of three years.shareholders held in the third year following the year of their election and, in each case, until their respective successors are elected and qualified. At this Annual Meeting, twoone Class III directorsI director will be elected to serve until the 20172018 annual meeting of shareholders and until his successor is elected and qualified, except in the event of such director’s earlier death, resignation or removal. The terms of office of the Class II and Class III directors will expire at the annual meetings of shareholders to be held in 2016 and 2017, respectively, upon the election and qualification of their successors, are electedexcept in the event of any such director’s earlier death, resignation or removal. Effective on the date of the 2015 Annual Meeting, the size of the Board will be reduced from five to four members and qualified.the number of Class I directors will be reduced from two directors to one director.

At the recommendation of its Nominating and Corporate Governance Committee, the Board is nominating Theodore J. Gaasche and Albert V. Russo,Edward B. Cloues, II, who are theis an incumbent Class III directors,I director, for reelection at the Annual Meeting. Although the Board does not expect that either of the persons nominatedMr. Cloues will be unable to serve as a director, should either of themhe become unavailable it is intended that the shares represented by proxies in the accompanying form will be voted for the election of a substitute nominee or nominees recommended to the Board by the Nominating and Corporate Governance Committee or, in the discretion of the Board, the position may be left vacant.

The following information relates to the nomineesnominee of the Board for election and the other directors whose terms of office do not expire this year.the Company.

NomineesNominee to serve until the 2018 Annual Meeting of Shareholders (Class I):

EDWARD B. CLOUES, II, age 67, has been a director of the Company since 1994 and currently serves as the Chairman of the Board. He also serves as a director of Hillenbrand, Inc. and as a director and Chairman of the Board of Penn Virginia Corporation. He had served as a director and Chairman of the Board of PVR GP, LLC, the General Partner of PVR Partners, L.P., until its sale in March 2014. For more than five years prior to its sale in April 2010, Mr. Cloues was a director, the Chairman of the Board and the Chief Executive Officer of K-Tron International, Inc., a material handling equipment manufacturer. Mr. Cloues has been a law firm partner at a major global law firm where he specialized in mergers and acquisitions and other business law matters. That experience combined with the experience gained from his former 12 year chief executive position with K-Tron International, Inc., which had been publicly held prior to its sale, has given him a strong background in dealing with complex business transactions and general management issues. Additionally, he brings to the Board a broad understanding of governance and compensation issues as a result of his service on several other public company boards.

Director continuing in office until the 2016 Annual Meeting of Shareholders (Class II):

LONNIE A. COOMBS, age 67, has been a director of the Company since 2001. Mr. Coombs is a certified public accountant and provides accounting, tax and business consulting services, and has been engaged in this occupation for more than the past five years with his firm, Lonnie A. Coombs, CPA. Mr. Coombs brings to the Board the expertise in financial and accounting matters he has accumulated over his almost 40 years as a practicing certified public accountant, and the diverse business knowledge he has gained in dealing through his practice with a broad range of commercial enterprises.

| - 8 - |

Directors continuing in office until the 2017 Annual Meeting of Shareholders (Class III):

THEODORE J. GAASCHE, age 52,53, has been a director of the Company since January 2013 and currently serves as the Vice Chairman of the Executive Committee of the Board. Mr. Gaasche is the Executive Vice President, Operations of Spartan Organization, Inc., a private company that advises various print, publishing and other portfolio companies. Mr. Gaasche was the President and Chief Executive Officer of the Company from August 2011 to January 2013. Mr. Gaasche had served as the Company’s Vice President - Corporate Development from February 2011 to August 2011. From 2009 through July 2011, he had been serving as Executive Vice President, Operations of Spartan Organization. Mr. Gaasche was the Company’s Vice President - Corporate Development on a less than full-time basis while he also was employed by Spartan Organization. For over twenty years until 2008, Mr. Gaasche held positions of increasing responsibility at various divisions of SunGard Data Systems Inc., most recently as the Chief Executive Officer of SunGard Availability Services, a division of SunGard that provided disaster recovery, managed information technology and related services. Mr. Gaasche brings to the boardBoard his extensive business experience, including his knowledge of the Company as its prior President and Chief Executive Officer.

ALBERT V. RUSSO, age 60,61, has been a director of the Company since 1996. Mr. Russo is the Managing Partner of real estate entities Russo Associates and Pioneer Realty and is a Partner of American Simlex Company, a textile exporter, and has held these positions for more than the past five years. Mr. Russo is also the Managing Partner of 401 Broadway Building, a real estate company which acquired its principal asset in 2006 from a court appointed receiver for 401 Broadway Realty Company, of which he was a general partner, in connection with the resolution of a dispute among the partners. Mr. Russo has been involved in the ownership and management of commercial real estate for more than 25 years and contributes to the Board his specialized knowledge of the real estate business.

DirectorsDirector continuing in office until the 2015 Annual Meeting of Shareholders (Class I):

EDWARD B. CLOUES, II, age 66, has been a director of the Company since 1994 and currently serves as the Chairman of the Board. He also serves as a director of Hillenbrand, Inc. and as a director and Chairman of the Board of Penn Virginia Corporation. He had served as a director and Chairman of the Board of PVR GP, LLC, the General Partner of PVR Partners, L.P., until its sale in March 2014. For more than five years prior to its sale on April 1, 2010, Mr. Cloues was a director, the Chairman of the Board and the Chief Executive Officer of K-Tron International, Inc., a material handling equipment manufacturer. Mr. Cloues has been a law firm partner at a major global law firm where he specialized in mergers and acquisitions and other business law matters. That experience combined with the experience gained from his former 12 year chief executive position with K-Tron International, Inc., which had been publicly held prior to its sale, has given him a strong background in dealing with complex business transactions and general management issues. Additionally, he brings to the Board a broad understanding of governance and compensation issues as a result of his service on several other public company boards.

JONATHAN B. WELLER, age 67,68, has been a director of the Company since 2007. After his retirement from full-time employment in April 2006, Mr. Weller worked as an Adjunct Lecturer at the Wharton School of the University of Pennsylvania from January 2007 to May 2009. From June 2004 to April 2006, Mr. Weller was Vice Chairman of Pennsylvania Real Estate Investment Trust, a public national owner, manager and operator of retail properties. He also served as Pennsylvania Real Estate Investment Trust’s President and Chief Operating Officer from 1994 to June 2004, and served on its Board of Trustees from 1994 to March 2006. Mr. Weller was a director of PVR GP, LLC, the General Partner of PVR Partners, L.P., until its sale in March 2014. He also is a member of the Advisory Board of Momentum Real Estate Fund, LLC. Mr. Weller brings to the Board 36 years of experience in the real estate business as well as experience in dealing with complex financial transactions. Also, his service on other public company boards enhances the Board’s ability to deal with governance and compensation matters.

Director continuing in office until the 2016 Annual Meeting of Shareholders (Class II):

LONNIE A. COOMBS, age 66, has been a director of the Company since 2001. Mr. Coombs is a certified public accountant and provides accounting, tax and business consulting services, and has been engaged in this occupation for more than the past five years with his firm, Lonnie A. Coombs, CPA. Mr. Coombs brings to the Board the expertise in financial and accounting matters he has accumulated over his almost 40 years as a practicing certified public accountant, and the diverse business knowledge he has gained in dealing through his practice with a broad range of commercial enterprises.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE TWO CLASS III NOMINEES.I NOMINEE.

| - |

PROPOSAL NUMBER 2

ADVISORY VOTE ON THE COMPENSATION PAID TO THE COMPANY’S NAMED EXECUTIVE OFFICERS

Under the Dodd-Frank Wall Street Reform and Consumer Protection Act (the “Dodd-Frank Act”) and Section 14A of the Securities Exchange Act of 1934, as amended, the Company’s shareholders are entitled to vote to approve, on an advisory basis, the compensation paid to the Company’s named executive officers as disclosed in this Proxy Statement in accordance with the rules of the Securities and Exchange Commission. The compensation paid to the Company’s named executive officers subject to the vote is disclosed in the compensation table and related narrative disclosure contained in this Proxy Statement.

The Board is asking the shareholders to indicate their support for the compensation paid to the Company’s named executive officers as described in this proxy statement by casting a non-binding advisory vote “FOR” the following resolution:

“RESOLVED, that the shareholders of AMREP Corporation hereby APPROVE, on a nonbinding advisory basis, the compensation paid to the Company’s named executive officers, as disclosed in the Company’s proxy statement for the 20142015 Annual Meeting of Shareholders pursuant to the compensation disclosure rules of the Securities and Exchange Commission, including the executive compensation table and narrative discussion disclosed therein.”

Because the vote is advisory, it is not binding on the Board or the Company. In accordance with the Dodd-Frank Act, the vote to approve the compensation of the Company’s named executive officers shall not be construed: (i) as overruling any decision by the Company or the Board; (ii) to create or imply any change in the fiduciary duties of the Company or the Board; or (iii) to create or imply any additional fiduciary duties for the Company or the Board. Nevertheless, the views expressed by the shareholders, whether through this vote or otherwise, are important to management and the Board and, accordingly, the Board and the Compensation and Human Resources Committee intend to consider the results of this vote in making determinations in the future regarding executive compensation arrangements.

Advisory approval of this proposal requires the affirmative vote of the holders of a majority of the shares present in person or represented by proxy and entitled to vote at the Annual Meeting.

THE BOARD UNANIMOUSLY RECOMMENDS A VOTE “FOR” THE APPROVAL OF THE COMPENSATION PAID TO OUR NAMED EXECUTIVE OFFICERS AS DISCLOSED IN THIS PROXY STATEMENT.

| - |

THE BOARD OF DIRECTORS AND ITS COMMITTEES

Governance Standards

The Company’s Common Stock is listed on the New York Stock Exchange, and the Company is subject to the New York Stock Exchange’s Corporate Governance Standards (the “Governance Standards”). The Governance Standards, among other things, generally require a listed company to have independent directors within the meaning of the Governance Standards as a majority of its board of directors and for the board to have an audit committee, a nominating/corporate governance committee and a compensation committee, each composed entirely of independent directors.

Based principally on their responses to questions to these persons regarding the relationships addressed by the Governance Standards and discussions with them, the Board has determined that other than his service as a director, each of Edward B. Cloues, II, Lonnie A. Coombs, Albert V. Russo and Jonathan B. Weller has no material relationship with the Company, either directly or as a partner, shareholder or officer of an organization that has a relationship with the Company, and, therefore, meets the director independence requirements of the Governance Standards, including the heightened independence standards applicable to audit committees and compensation committees.Standards. The Board was informed that Mr. Coombs, who is a certified public accountant, (i) for many years has provided, and expects to continue to provide, business and tax consulting services to certain companies owned by Nicholas G. Karabots, a beneficial owner of approximately 26% of the outstanding shares of the Company, including companiesa company that are customers foris a customer of the Company’s newsstand distribution and subscription and product fulfillment services business, (ii) the revenues from such business and tax consulting services for the Company’s last three fiscal years have accounted for from 3.1% to 13.5%5.8% of Mr. Coombs’ professional service revenues over those periods and (iii) Mr. Coombs is also a director of a private company controlled by Mr. Karabots and in the past has served as a director of other such companies. However, the Board concluded that Mr. Coombs’ relationships with Mr. Karabots and his companies is as an independent contractor, and not as an employee, partner, shareholder or officer, and would not interfere with Mr. Coombs’ independence from the Company’s management.

As required by the Governance Standards, the Board has adopted Corporate Governance Guidelines (the “Guidelines”) that address various matters involving the Board and the conduct of its business. The Board has also adopted a Code of Business Conduct and Ethics setting forth principles of business conduct applicable to the directors, officers and employees of the Company. The Guidelines and Code of Business Conduct and Ethics, as well as the charters of the Board’s Nominating and Corporate Governance Committee, Audit Committee and Compensation and Human Resources Committee, may be viewed under “Corporate Governance” on the Company’s website atwww.amrepcorp.com, and written copies will be provided to any shareholder upon written request to the Company at AMREP Corporation, 300 Alexander Park, Suite 204, Princeton, New Jersey 08540, Attention: Corporate Secretary. The Company intends to disclose on its website any amendment to or waiver of any provision of the Code of Business Conduct and Ethics that applies to any of its principal executive officer, principal financial officer, principal accounting officer or controller or persons performing similar functions.

Directors are expected to attend Annual Meetings of Shareholders, and all of the directors attended last year’s Annual Meeting. The Board held eighttwelve meetings during the last fiscal year, and allyear. All of the directors attended at least 75% of the total number of those meetings other than Mr. Russo. All of the directors also attended at least 75% of the total of the meetingsheld during the last fiscal year of the Board and its Committees of which they were members other than Mr. Russo with respect to the Board’s Nominating and Corporate Governance Committee.members. Pursuant to the Guidelines, the Board has established a policy that the non-management directors meet in executive session at least twice per year and that the independent directors also meet in executive session at least twice per year. Since December 31, 2010, no member of management has been a director. The Chairman of the Board (currently, Edward B. Cloues, II), if in attendance, will be the presiding director at each such executive session; otherwise, those attending may select a presiding director. Since December 31, 2010, no member of management has been a director.

| - |

Any shareholder or other interested person wishing to communicate with the Board or any of the directors may send a letter addressed to the member or members of the Board to whom the communication is directed in care of AMREP Corporation, 300 Alexander Park, Suite 204, Princeton, New Jersey 08540, Attention: Corporate Secretary. All such communications will be forwarded to the specified addressee(s).

Executive Committee and Board Leadership Structure

The Board has an Executive Committee, which generally has the power of the Board and acts, as needed, between meetings of the Board. Since the Company has no chief executive officer, the Executive Committee is charged with the oversight of the Company’s business. The members of the Executive Committee are Messrs. Cloues, Gaasche and Russo. Mr. Cloues is Chairman of the Board and of the Executive Committee, and Mr. Gaasche is Vice Chairman of the Executive Committee. During the last fiscal year, the Executive Committee held no meetings on a formal basis but its members interacted frequently on an informal basis.

While it is unusual for a company not to have a chief executive officer, the Company believes that its leadership structure is appropriate and works well for it since, as previously noted, the membership of the Executive Committee includes Mr. Cloues who is an experienced former public company chief executive officer, Mr. Gaasche who is the former chief executive officer of the Company and Mr. Russo who is one of the major shareholders of the Company.

Nominating and Corporate Governance Committee

The Board has a Nominating and Corporate Governance Committee that operates under a written charter adopted by the Board. Each member of the Nominating and Corporate Governance Committee is an independent director, as defined by the Governance Standards. The members of this Committee are Messrs. Cloues (Chairman), Coombs, Russo and Weller, each of whom has been determined by the Board to be an independent director within the meaning of the Governance Standards. This Committee reports regularly to the Board concerning its activities. The Nominating and Corporate Governance Committee held twofour meetings during the last fiscal year. In addition, a subcommittee of the Nominating and Corporate Governance Committee held one meetingtwo meetings during the last fiscal year to consider and approve certain related party transactions.

The duties of the Nominating and Corporate Governance Committee include identifying individuals the Committee considers qualified to be elected Board members consistent with criteria approved by the Board, and recommending persons to be nominated by the Board for election by the shareholders. When considering a nominee for election as a director, the Committee considers the experience, skills and knowledge of business and management practices a candidate may possess and the perspective he or she may bring to the Board, and employs criteria calling for, among other things, the person’s personal and professional integrity, good judgment, high level of ability and business acumen, and experience in the Company’s industries, as well as the ability of the nominee to devote sufficient time to performing his or her duties on the Board in an effective manner. Although the Committee has no specific policy regarding the diversity of the membership of the Board, it is the objective of the Committee that the Board be comprised of persons of diverse backgrounds such that as a unit the members of the Board will possess the necessary skills to appropriately discharge their responsibilities as the Company’s directors. The Committee is also responsible for periodically reviewing and recommending changes to the Guidelines and for overseeing the Company’s corporate governance practices.

| - |

The Nominating and Corporate Governance Committee will consider candidates for director recommended by shareholders on the same basis as any other proposed nominees. Any shareholder desiring to propose a candidate for selection as a nominee of the Board for election at the 20152016 Annual Meeting of Shareholders may do so by sending a written communication no later than May 1, 20152, 2016 to the Nominating and Corporate Governance Committee, AMREP Corporation, 300 Alexander Park, Suite 204, Princeton, New Jersey 08540, Attention: Corporate Secretary, identifying the proposing shareholder, specifying the number of shares of Common Stock held and stating the name and address of the proposed nominee and the information concerning such person that the regulations of the Securities and Exchange Commission require be included in a proxy statement relating to such person’s proposed election as a director.

Audit Committee

The Board has an Audit Committee that operates under a written charter adopted by the Board. Each member of the Audit Committee is an independent director, as defined by the Governance Standards. The members of this Committee are Messrs. Coombs (Chairman), Cloues and Weller, each of whom has been determined by the Board to be an independent director within the meaning of the Governance Standards. The Board has also determined that Mr. Coombs, who is a certified public accountant, qualifies as an audit committee financial expert within the meaning of Securities and Exchange Commission regulations. This Committee reports regularly to the Board concerning its activities. The Audit Committee held sixeight meetings during the last fiscal year.

The duties of the Audit Committee include (i) appointing the Company’s independent registered public accounting firm, approving the services to be provided by that firm and its compensation and reviewing that firm’s independence and performance of services, (ii) reviewing the scope and results of the yearly audit by the independent registered public accounting firm, (iii) reviewing the Company’s system of internal controls and procedures, (iv) reviewing with management and the independent registered public accounting firm the Company’s annual and quarterly financial statements, (v) reviewing the Company’s financial reporting and accounting standards and principles and (vi) overseeing the administration and enforcement of the Company’s Code of Business Conduct and Ethics. In addition to the Audit Committee’s responsibilities set forth above, the Audit Committee has, pursuant to its charter, primary responsibility in the oversight of risks that could affect the Company.

Compensation and Human Resources Committee

The Board has a Compensation and Human Resources Committee that operates under a written charter adopted by the Board. Each member of the Compensation and Human Resources Committee is an independent director, as defined by the Governance Standards. The members of this Committee are Messrs. Cloues, Russo and Weller (Chairman), each of whom has been determined by the Board to be an independent director within the meaning of the Governance Standards. This Committee reports regularly to the Board concerning its activities. During the last fiscal year, the Compensation and Human Resources Committee held fivesix meetings on a formal basis and met periodically on an informal basis. In addition, a subcommittee of the Compensation and Human Resources Committee held three meetingsone meeting during the last fiscal year to consider and approve certain equity compensation awards.

| - |

The Compensation and Human Resources Committee is responsible for reviewing and approving the corporate goals and objectives applicable to the Company’s chief executive officer, if any, and determining his compensation and that of the Company’s other executive officers, establishing overall compensation and benefit levels and fixing bonus pools for other employees, and making recommendations to the Board concerning other matters relating to employee and director compensation. With respect to salaries, bonuses and other compensation and benefits, the decisions and recommendations of the Compensation and Human Resources Committee are subjective and are not based on any list of specific criteria. In the past, factors influencing the Committee’s decisions regarding executive salaries have included the Committee’s assessment of the executive’s performance and any changes in functional responsibility. In determining the salary to be paid to a particular individual, the Committee applies these and other criteria, while also using its best judgment of compensation applicable to other executives holding comparable positions both within the Company and at other companies. Additionally, the Committee in developing its recommendations regarding director compensation looks to director compensation at other public companies of the Company’s size. Executive officers of the Company do not play a role in determining their compensation. Neither the Board nor the Committee has engaged compensation consultants for the purposes of determining or advising upon executive or director compensation.

Risk Oversight

The full Board and its Executive Committee are actively involved in risk oversight and management of risk, with the full Board having ultimate responsibility for the oversight of risks facing the Company and for the management of those risks, but the Audit Committee conducts preliminary evaluations of risk and addresses risk prior to review by the Board. The Audit Committee considers and reviews with management the Company’s internal control processes. The Audit Committee also considers and reviews with the Company’s independent registered public accounting firm the adequacy of the Company’s internal controls, including the processes for identifying significant risks or exposures, and elicits recommendations for the improvement of such procedures where needed. In addition to the Audit Committee’s role, the full Board is involved in the oversight and administration of risk and risk management practices by overseeing members of senior management in their risk management capacities. Members of the Company’s senior management have day-to-day responsibility for risk management and establishing risk management practices, and members of management are expected to report matters relating specifically to the Audit Committee directly thereto, and to report all other matters directly to the Executive CommitteeChairman of the Board or the Board as a whole. Members of the Company’s senior management have an open line of communication to the Executive CommitteeChairman of the Board and the Board as a whole and have the discretion to raise issues from time-to-time in any manner they deem appropriate, and management’s reporting on issues relating to risk management typically occurs through direct communication with directors, the Chairman of the Board or the Audit Committee or Executive Committee members as matters requiring attention arise.

In furtherance of its risk oversight responsibilities, the Board has evaluated the Company’s overall compensation policies and practices for its employees to determine whether such policies and practices create incentives that could reasonably be expected to affect the risks faced by the Company and its management, has further assessed whether any risks arising from these policies and practices are reasonably likely to have a material adverse effect on the Company, and has concluded that the risks arising from the Company’s policies and practices are not reasonably likely to have a material adverse effect on the Company.

EXECUTIVE OFFICERS

For information with respect to executive officers, see “Executive Officers of the Registrant” in Part I of the Company’s Annual Report on Form 10-K for the year ended April 30, 2014,2015, filed pursuant to the Securities Exchange Act of 1934.1934, as amended.

| - |

COMPENSATION OF EXECUTIVE OFFICERS

The following table contains summary information regarding the compensation of the Company’s executive officers as required by Item 402(n) of Regulation S-K.

Summary Compensation Table

| Name and Principal Position | Year(1) | Salary ($) | Bonus ($) | Stock Awards(2) ($) | All Other Compensation(3) ($) | Total ($) | ||||||||||||||||

| MICHAEL P. DULOC(4) | 2014 | 382,500 | - | (5) | - | 86,847 | (6) | 469,347 | ||||||||||||||

| President and Chief Executive | 2013 | 382,500 | 7,560 | (5) | - | 80,281 | (6) | 470,341 | ||||||||||||||

| Officer of Kable Media Services, Inc. | ||||||||||||||||||||||

| RORY BURKE(4) | 2014 | 271,038 | 12,052 | (7) | 44,520 | 1,955 | 329,565 | |||||||||||||||

| President and Chief Executive Officer of Palm Coast Data LLC | - | |||||||||||||||||||||

| PETER M. PIZZA | 2014 | 199,400 | - | 40,800 | 2,483 | 242,683 | ||||||||||||||||

| Vice President and Chief | 2013 | 197,400 | - | - | 6,253 | 203,653 | ||||||||||||||||

| Financial Officer of the Company | ||||||||||||||||||||||

| CHRISTOPHER V. VITALE(8) | 2014 | 210,000 | - | 61,200 | 6,576 | 277,776 | ||||||||||||||||

| Vice President, General Counsel | 2013 | 33,409 | - | - | 1,175 | 34,584 | ||||||||||||||||

| and Secretary of the Company | ||||||||||||||||||||||

| Name and Principal Position | Year(1) | Salary ($) | Bonus ($) | Stock Awards(2) ($) | All Other Compensation(3) ($) | Total ($) | ||||||||||||||||

| RORY BURKE | 2015 | 288,177 | - | - | 17,576 | (5) | 350,273 | |||||||||||||||

| President and Chief Executive Officer of Palm Coast Data LLC | 2014 | 271,038 | 12,052 | (4) | 44,520 | 1,955 | 329,565 | |||||||||||||||

| CHRISTOPHER V. VITALE | 2015 | 227,079 | - | 41,400 | 2,076 | 270,555 | ||||||||||||||||

| Executive Vice President, Chief Administrative Office, General Counsel and Secretary of the Company | 2014 | 210,000 | - | 61,200 | 6,576 | 277,776 | ||||||||||||||||

| PETER M. PIZZA | 2015 | 205,097 | - | 20,700 | 2,076 | 227,873 | ||||||||||||||||

| Vice President and Chief Financial Officer of the Company | 2014 | 199,400 | - | 40,800 | 2,483 | 242,683 | ||||||||||||||||

| MICHAEL P. DULOC(6) | 2015 | 288,482 | - | - | 22,358 | (8) | 310,840 | |||||||||||||||

| Former President and Chief Executive Officer of Kable Media Services, Inc. | 2014 | 382,500 | - | (7) | - | 86,847 | (8) | 469,347 | ||||||||||||||

| (1) | The year references are to the fiscal years ended April 30. |

| (2) | The amounts indicated represent the grant date fair value related to awards of restricted stock granted during fiscal years 2014 and 2015 computed in accordance with stock-based accounting rules (FASB ASC Topic 718). The determination of this value is based on the methodology set forth in Note |

| (3) | The amounts reported include auto allowances for certain of the named executives and payment of life insurance premiums and, additionally, in the case of |

| (4) |

| The Compensation and Human Resources Committee established an incentive compensation plan for fiscal 2014 for Mr. Burke under which he was entitled to earn a cash bonus based upon the levels of revenue and earnings (as defined) attributable to Palm Coast Data LLC, an indirect subsidiary of the Company, above stated targets. For fiscal 2014, |

| (6) | In connection with the sale on February 9, 2015 of Kable Media Services, Inc. and certain other indirect subsidiaries of the Company, |

| (7) | The Compensation and Human Resources Committee established an incentive compensation plan for fiscal 2014 for Mr. Duloc under which he was entitled to earn a cash bonus based upon the levels of revenue and earnings (as defined) attributable to certain businesses of the Company above stated targets. For fiscal 2014, the targets were not reached and no bonus was earned. |

| - 15 - |

| (8) | In addition to auto allowances and payment of life insurance premiums, the amounts reported include housing expenses of $57,310 for 2014 and $13,856 for 2015, and partial reimbursement for club membership dues. |

Outstanding Equity Awards at April 30, 20142015

| Stock Awards | Stock Awards | |||||||||||||||||||||||

| Name | Number of Shares or Units of Stock that have not Vested (#) | Market Value of Shares of Units of Stock that Have not Vested ($) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that have not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or other Rights that have not Vested ($)(1) | Equity Incentive Plan Awards: Number of Unearned Shares, Units or Other Rights that have not Vested (#) | Equity Incentive Plan Awards: Market or Payout Value of Unearned Shares, Units or other Rights that have not Vested ($)(1) | ||||||||||||||||||

| RORY BURKE | 4,000 | (2) | $ | 20,440 | ||||||||||||||||||||

| CHRISTOPHER V. VITALE | 12,000 | (3) | $ | 61,320 | ||||||||||||||||||||

| PETER M. PIZZA | 7,000 | (4) | $ | 35,770 | ||||||||||||||||||||

| MICHAEL P. DULOC | - | - | - | - | - | - | ||||||||||||||||||

| RORY BURKE | - | - | 6,000 | (2) | $ | 32,640 | ||||||||||||||||||

| PETER M. PIZZA | - | - | 6,000 | (3) | $ | 32,640 | ||||||||||||||||||

| CHRISTOPHER V. VITALE | - | - | 9,000 | (3) | $ | 48,960 | ||||||||||||||||||

| (1) | Value is based on the closing price of Common Stock of |

| (2) | The restricted shares of Common Stock will vest |

| (3) |

| (4) | 1,000 restricted shares of Common Stock vested on July 8, 2015 and 2,000 restricted shares of Common Stock vested on August 1, 2015. 2,000 restricted shares of Common Stock will vest on August 1, 2016 and 2,000 restricted shares of Common Stock will vest one-half on July 8, 2016 and one-half on July 8, 2017, subject in each case to the |

On July 8, 2014,13, 2015, Mr. PizzaVitale was awarded 3,000 restricted shares ofCommon Stock,and Mr. Vitale was awarded 6,000 restricted shares ofCommon Stock. Each award of restricted shares ofCommon Stock which will vest one-third on July 8, 2015,13, 2016, one-third on July 8, 201613, 2017 and one-third on July 8, 2017,13, 2018, subject to the continued employment of the officerMr. Vitale on each vesting date. On July 13, 2015, the Compensation and Human Resources Committee approved an increase of Mr. Vitale’s annual base salary from $235,000 to $240,000 effective as of August 10, 2015.

| - |

Messrs. Duloc and Pizza have been employees of the Company or its subsidiaries since prior to March 1, 2004 and participate in the Company’s Retirement Plan for Employees (the “Retirement Plan”), which was amended effective January 1, 1998 to change it into a cash balance defined benefit plan. The Retirement Plan was subsequently frozen effective March 1, 2004, so that in the determination of the benefit payable, a participant’s compensation from and after March 1, 2004 is not taken into account. A participant’s benefit under the amended Retirement Plan is now comprised of (a) the participant’s cash balance as of February 29, 2004, plus interest on the cash balance (currently credited annually at the 30-year Treasury Rate for December of the previous year as published by the Board of Governors of the Federal Reserve System), and (b) the participant’s periodic pension benefit under the Retirement Plan as at December 31, 1997 had the participant been at normal retirement age at that date. In April 2015, Mr. Duloc elected to receive a distribution of his cash balance in the Retirement Plan in the amount of $39,273. Assuming that theyMr. Duloc elects the life annuity form of pension at age 65, his annual retirement benefits are estimated to be $6,236. Assuming that Mr. Pizza (i) continuecontinues to be employed until age 65 and (ii) electelects the life annuity form of pension, thehis annual retirement benefits are estimated to be $10,251 for Mr. Duloc and $5,230 for Mr. Pizza.$4,921.

Other than as described below, the Company’s executive officers are not subject to agreements or other arrangements that provide for payments upon a change in control of the Company and the Company’s policies for severance payments upon termination of employment apply to the executive officers on the same basis as the Company’s other salaried employees. The Compensation and Human Resources Committee retains the discretion to enter into severance agreements with individual executive officers on terms satisfactory to it. Effective as of March 5, 2014, Palm Coast Data LLC entered into a change of control agreement (the “COC Agreement”) with Mr. Burke. The COC Agreement provides for certain rights and benefits in the event Palm Coast Data LLC terminates Mr. Burke’s employment without cause or Mr. Burke terminates his employment with Palm Coast Data LLC for good reason (as each of those terms are defined in the COC Agreement), and in each case in connection with a change in control of the Company or Palm Coast Data LLC (a “double-trigger”), including severance payable to Mr. Burke equal to one times his annual base salary and continued health and medical insurance to Mr. Burke for one year. In addition, if the change of control is solely with respect to Palm Coast Data LLC, the COC Agreement provides that any vesting, restrictions or conditions on the exercisability or the sale of equity awards granted by the Company or its affiliates to Mr. Burke shall lapse or otherwise be deemed fully vested, accelerated or otherwise satisfied. These rights and benefits are subject to certain customary non-competition and non-solicitation obligations and are contingent upon the execution of a release.

In 2006, the Board adopted, and the shareholders approved, the 2006 Equity Compensation Plan, which authorizes stock-based awards of various kinds to employees covering up to a total of 400,000 shares of Common Stock. Under the terms of the 2006 Equity Compensation Plan, its administrator has the discretion to accelerate the vesting of, or otherwise remove restrictions on, awards under the 2006 Equity Compensation Plan upon a change in control of the Company.

COMPENSATION OF DIRECTORS

Compensation for the non-employee members of the Board is approved by the Board, which considers recommendations for director compensation from the Company’s Compensation and Human Resources Committee.

Each non-employee member of the Board is paid an annual fee of $80,000 in equal quarterly installments and an additional $1,500 for each Board meeting attended in person or by telephone at meetings called for attendance in person and $500 for each Board meeting attended by telephone unless, in the case of a telephonic meeting, the Board determines that the meeting and attendant preparation were so brief that no payment is warranted. Additionally, the Chairmen of the Audit Committee and the Compensation and Human Resources Committee are each paid an annual fee of $7,500, and each other member of those Committees is paid an annual fee of $5,000, in equal quarterly installments. The members of the Nominating and Corporate Governance Committee serve without additional compensation. A further fee of $23,500 was paid in fiscal 2015 to each of Edward B. Cloues, II and Jonathan B. Weller for their services as members of a special committee of the Board established to address certain strategic transactions, including the sale of the Company Group as described below under the heading “Certain Transactions.” Also, in addition to the fees described above, Edward B. Cloues, II is paid an annual fee of $135,000 for his services as Chairman of the Board and of the Executive Committee in equal monthly installments, and Theodore J. Gaasche is paid a monthly fee of $5,000 for his services as Vice Chairman of the Executive Committee.

| - |

The following table summarizes the compensation earned by the Company’s directors for fiscal 2014:2015:

| Name | Fees Earned or Paid in Cash ($) | Total ($) | Fees Earned or Paid ($) | Total ($) | ||||||||||||

| Edward B. Cloues, II | 233,000 | 233,000 | 258,500 | 258,500 | ||||||||||||

| Lonnie A. Coombs | 96,500 | 96,500 | 97,500 | 97,500 | ||||||||||||

| Theodore J. Gaasche | 149,000 | 149,000 | 149,500 | 149,500 | ||||||||||||

| Albert V. Russo | 90,500 | 90,500 | ||||||||||||||

| Samuel N. Seidman(1) | 44,000 | 44,000 | ||||||||||||||

| Albert V. Russo(1) | 48,000 | 48,000 | ||||||||||||||

| Jonathan B. Weller | 103,000 | 103,000 | 126,000 | 126,000 | ||||||||||||

| (1) | During fiscal 2015, Mr. |

EQUITY COMPENSATION PLAN INFORMATION

The following table sets forth information as of April 30, 20142015 concerning Common Stock of the Company that is issuable under its compensation plans.

| Plan Category | (A) Number of securities to be issued upon exercise of outstanding options, warrants and rights | (B) Weighted average exercise price of outstanding options, warrants and rights | (C) Number of securities remaining available for future issuance under equity compensation plans (excluding securities reflected in column (A)) | |||||||||

| Equity compensation plans approved by shareholders | - | - | 376,000 | (1) | ||||||||

| Equity compensation plans not approved by shareholders | - | - | - | |||||||||

| Total | - | - | 376,000 | |||||||||

Plan Category | (A) | (B) | (C) | |||||||||

| Equity compensation plans approved by shareholders | - | - | 364,000 | (1) | ||||||||

| Equity compensation plans not approved by shareholders | - | - | - | |||||||||

| Total | - | - | 364,000 | |||||||||

| (1) | Represents shares of Common Stock available for grant under the 2006 Equity Compensation Plan less outstanding grants of restricted shares of Common Stock previously made under the 2006 Equity Compensation Plan. |

| - 18 - |

CERTAIN TRANSACTIONS

Prior to February 9, 2015, the Company was engaged in the Newsstand Distribution Services business and the Product Packaging and Fulfillment Services business, operated by Kable Media Services, Inc., Kable Distribution Services, Inc. (“Kable Distribution”), Kable News Company, Inc., Kable News International, Inc., Kable Distribution Services of Canada, Ltd. and Kable Product Services, Inc. (collectively, the “Company Group”). The Newsstand Distribution Services business operated a national distribution business that distributed publications and the Product Packaging and Fulfillment Services business offered electronic and traditional commerce solutions to customers.

On February 9, 2015, American Investment Republic Co. (“Seller”), a subsidiary of the Company, entered into a stock purchase agreement (the “Stock Purchase Agreement”) with DFI Holdings, LLC (“Distribution Buyer”) and KPS Holdco, LLC (“Products Buyer”, and together with Distribution Buyer, the “MD Buyers”), where each MD Buyer was controlled by Michael P. Duloc. The closing of the transactions contemplated by the Stock Purchase Agreement occurred on February 9, 2015.

Prior to February 9, 2015, Mr. Duloc was the chief executive officer and president of the Company Group and certain other subsidiaries of the Company and was a principal executive officer of the Company. In connection with the closing of the transactions contemplated by the Stock Purchase Agreement, effective on February 9, 2015, Mr. Duloc was removed as an officer of each direct and indirect subsidiary of the Company and ceased to be a principal executive officer of the Company. Mr. Duloc is the son-in-law of Nicholas G. Karabots, a significant shareholder of the Company. Mr. Duloc’s spouse, who is Mr. Karabots’ daughter, is an officer of one of Mr. Karabots’ companies to which the Company Group and the Company’s subscription fulfillment services business provide services. Mr. Karabots was a director and Vice Chairman of the Board and of the Executive Committee of the Board until January 22, 2013 and was Chairman of the Compensation and Human Resources Committee of the Board until November 28, 2012.

Pursuant to the Stock Purchase Agreement, Products Buyer acquired, through the purchase of all of the capital stock of Kable Product Services, Inc., the Company’s Product Packaging and Fulfillment Services business. Immediately following such acquisition, pursuant to the Stock Purchase Agreement, Distribution Buyer acquired, through the purchase of all of the capital stock of Kable Media Services, Inc. (“KMS”), the Company’s Newsstand Distribution Services business operated by KMS’s direct and indirect subsidiaries, namely Kable Distribution Services, Inc. (“Kable Distribution”), Kable News Company, Inc., Kable News International, Inc. and Kable Distribution Services of Canada, Ltd.

Consideration for MD Buyers acquiring the Company Group included MD Buyers paying Seller $2,000,000, which consisted of $400,000 of cash paid by MD Buyers on February 9, 2015 and $1,600,000 paid by execution by MD Buyers of a secured promissory note, dated as of February 9, 2015 (the “Buyer Promissory Note”).

As a result of the transaction, other than (i) the elimination of substantially all of the intercompany amounts of the Company Group due to or from the Company and its direct and indirect subsidiaries (not including the Company Group) through offset and capital contribution and (ii) certain other limited items identified in the Stock Purchase Agreement and the agreements entered into in connection with the Stock Purchase Agreement, the Company Group retained all of its pre-closing assets, liabilities, rights and obligations. At February 9, 2015, the Company Group had assets of $4,564,000 and liabilities of $15,732,000, which included $11,605,000 of negative working capital with respect to Kable Distribution. The negative working capital of Kable Distribution represented its net payment obligation due to publisher clients and other third parties. The Company recognized a pretax gain of $10,479,000 on its financial statements as a result of the transaction in the fourth quarter of 2015.

| - 19 - |

The following agreements, each dated as of February 9, 2015, were entered into in connection with the Stock Purchase Agreement:

| · | Buyer Promissory Note. MD Buyers entered into the Buyer Promissory Note, which requires MD Buyers to pay Seller $1,600,000 in 24 equal monthly instalments, commencing on February 1, 2016, with interest due and payable monthly commencing on March 1, 2015. Interest accrues at a rate per annum determined on the first business day of each month equal to three percent plus the “prime rate,” as published in The Wall Street Journal. The Buyer Promissory Note contains customary events of default and representations, warranties and covenants provided by MD Buyers to Seller, and is secured by a pledge of substantially all of the personal property of MD Buyers and the Company Group, pari passu with other secured obligations owed by MD Buyers and the Company Group to Seller under the Stock Purchase Agreement and the agreements entered into in connection with the Stock Purchase Agreement. |

| · | Releases. (a) Seller entered into a release agreement in favor of the Company Group and its affiliates and (b) the Company Group, MD Buyers and Mr. Duloc entered into release agreements in favor of Seller and its affiliates. Subject to certain limited exceptions, each of the release agreements released all claims that the releasing party may have had against the parties being released. |

| · | Line of Credit. Seller provided the Company Group with a secured revolving line of credit pursuant to a line of credit promissory note (the “Line of Credit”). The Line of Credit permits the Company Group to borrow from Seller up to a maximum principal amount of $2,000,000 from February 9, 2015 until May 11, 2015, $1,500,000 from May 12, 2015 until August 5, 2016 and $1,000,000 from August 6, 2016 until February 9, 2017, with interest due and payable monthly commencing on March 1, 2015. |

The principal amount permitted to be borrowed under the Line of Credit is subject to the following borrowing base: (a) from February 9, 2015 until May 11, 2015, (i) 50% of eligible accounts receivable of the Company Group and (ii) 45% of eligible unbilled receivables of Kable Distribution and from May 12, 2015 until February 9, 2017, (i) 50% of eligible accounts receivable of the Company Group and (ii) 30% of eligible unbilled receivables of Kable Distribution.

Amounts outstanding under the Line of Credit accrue interest at a rate per annum as determined on the first business day of each month equal to three percent plus the “prime rate,” as published in The Wall Street Journal. Amounts available but not advanced under the Line of Credit accrue “unused” fees at a rate of 1.0% per annum, payable on the first day of each month. The Line of Credit contains customary events of default and representations, warranties and covenants provided by the Company Group to Seller, and is secured by a pledge of substantially all of the personal property of MD Buyers and the Company Group, pari passu with other secured obligations owed by MD Buyers and the Company Group to Seller under the Stock Purchase Agreement and the agreements entered into in connection with the Stock Purchase Agreement.

| - 20 - |

| · | Guaranty of Company Group. MD Buyers, the Company Group and Seller entered into a guaranty agreement pursuant to which MD Buyers and the Company Group guaranteed the full and prompt payment and performance of all agreements, covenants and obligations of MD Buyers or any member of the Company Group, including under the Stock Purchase Agreement, the Line of Credit, the Buyer Promissory Note and the other agreements entered into in connection with the Stock Purchase Agreement. |

| · | Security Agreement. MD Buyers, the Company Group and Seller entered into a security agreement pursuant to which MD Buyers and the Company Group pledged and granted a security interest in substantially all of their personal property to Seller in order to secure the obligations of each MD Buyer and each member of the Company Group, including under the Stock Purchase Agreement, the Line of Credit, the Buyer Promissory Note and the other agreements entered into in connection with the Stock Purchase Agreement. |

The Company and its remaining direct and indirect subsidiaries retained their obligations under the Company’s defined benefit retirement plan, without any funding acceleration or other changes in any of the obligations thereunder as a result of the sale of the Company Group. In addition, a subsidiary of the Company retained its ownership of a warehouse used by Kable Product Services, Inc. in its operations, which remains subject to a market rate lease with Kable Product Services, Inc. with a term that expires in November 2018 and remains subject to a mortgage note payable to a third party lender with a maturity date of February 2018 and an outstanding principal balance of $4,087,000 as of April 30, 2015.

On August 4, 1993, pursuant to an agreement with Nicholas G. Karabots and two corporations he then owned, the Company, in exchange for 575,593 shares of Common Stock, acquired various rights to distribute magazines for its distribution business. Prior to that date Mr. Karabots had no affiliation with the Company. The distribution rights covered various magazines published by unaffiliated publishers, as well as magazines published by Mr. Karabots’ companies. Mr. Karabots was a director and Vice Chairman of the Board and of the Executive Committee until January 22, 2013 and was Chairman of the Compensation and Human Resources Committee until November 28, 2012. Mr. Karabots is the father-in-law of Michael P. Duloc, one of the Company’s executive officers. Mr. Duloc’s spouse, who is Mr. Karabots’ daughter, is an officer of one of Mr. Karabots’ companies to which the Company provides services.

A committeesub-committee of the BoardNominating and Corporate Governance Committee (the “Independent Committee”), comprised of directors whom the Board found to be independent of Mr. Karabots, was established with authority to consider and, if deemed appropriate, to approve new contracts and material modifications to existing contracts between the Company and companies owned or controlled by Mr. Karabots. The Independent Committee hadhas no written charter establishing its policies and procedures. The approvals it has granted were based upon determinations after due inquiry that the contract terms were fair and reasonable and no less favorable to the Company than would be obtained in an arm’s length transaction with a non-affiliate having a volume of business with the Company comparable to that of Mr. Karabots. The Nominating and Corporate Governance Committee, which was established in June 2012 and is comprised of all of the independent directors, has succeeded to the responsibilities of the Independent Committee, and the terms of any future material transaction with Mr. Karabots or companies owned or controlled by Mr. Karabots, including his publishing company, will be subject to the approval of that Committee or a subcommittee of that Committee.

The conduct ofPrior to February 9, 2015, the Company’s magazinenewsstand distribution business involves the purchase ofpurchased magazines from publishing companies, including a company owned or controlled by Mr. Karabots, and their resaleresold those magazines to wholesalers. During the fiscal years ended April 30, 20132014 and April 30, 2014,2015, the Company distributed magazines published by Mr. Karabots’ company pursuant to a distribution contract as amended, approved by the Independent Committee that doesdid not have an expiration but doesdid provide Mr. Karabots’ company with the ability to terminate the contract at the end of any month with 60 days’ prior written notice. Mr. Karabots’ company iswas the Company’s largest magazinenewsstand distribution services customer. The Company’s revenue from its distribution contract with Mr. Karabots’ company was approximately $1,238,000 for fiscal 2013 and $1,123,000 for fiscal 2014.2014 and $803,000 for fiscal 2015. As described above, the Company’s newsstand distribution business was sold on February 9, 2015.

| - 21 - |

Additionally, the